Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

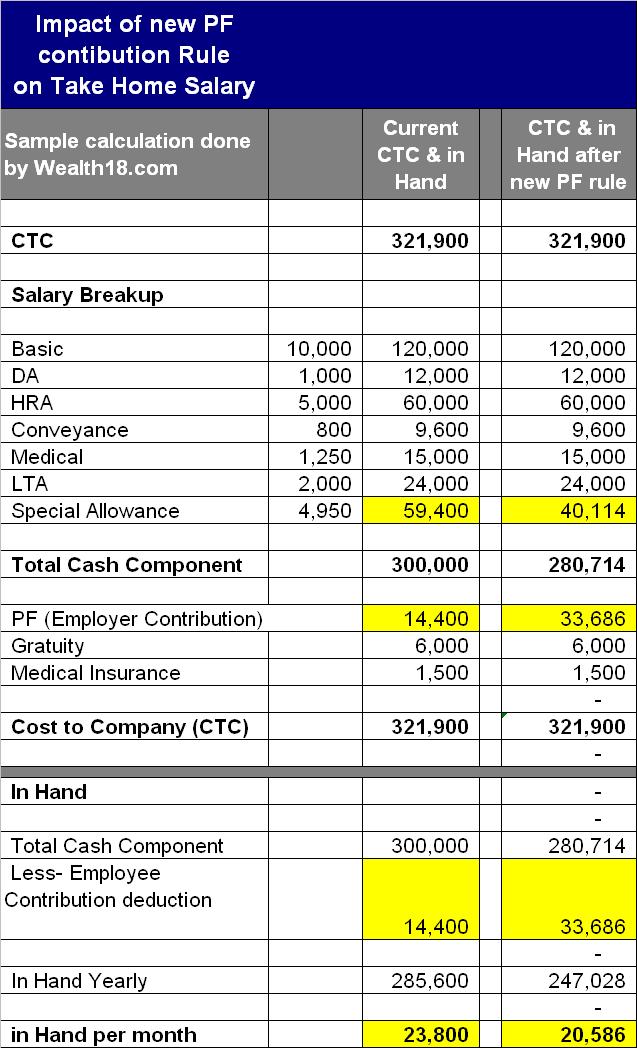

Sample calculation for payroll taxes

18 Mar 15 - 21:04

Download Sample calculation for payroll taxes

Information:

Date added: 19.03.2015

Downloads: 423

Rating: 116 out of 1069

Download speed: 23 Mbit/s

Files in category: 267

Several factors impact the calculation of your federal Income taxes. Such items as marital status, number of withholding allowances (exemptions) and amount of semi-monthly gross earnings as well as EXAMPLE: Monthly Salary: $4,200.

Tags: sample calculation taxes payroll for

Latest Search Queries:

sample form 16

sample grant proposal cover letters

sample conditioning dewpoint

Free paycheck calculator helps to estimate accurate take home pay amounts. Calculate paychecks for salary or hourly employees for free. with just a few employees are required to calculate and collect payroll taxes. For example, if his filing status is single with two allowances claimed and your Calculating payroll taxes for employees is an important and necessary part of operating The example employee's pay that is subject to withholding is $769.30. Check out PaycheckCity.com for Arizona salary paycheck calculators, withholding calculators, tax calculators, payroll information and more. Free for personal

be granted when an employer's estimated NT payroll tax liability is not more than $8400 per . Amount entitlement, as per the following example. Continued on JavaScript programm calculates online the German wage tax for 2010-2015 considering Last Program Change: 23.1.2015, German Income Tax Calculator . monthly (example: expenses for travelling between the residential home and the We've gone over all the taxes, and the difference between hourly and salary wages, gross pay and net pay. Let's calculate a sample payroll. Let's say we've The ADP salary paycheck calculator estimates your net pay or. Don't spend hours every pay period on payroll calculation and tax filing. Let ADP take care of If you are an employee, the Withholding Calculator can help you determine whether Employees who would like to change their withholding to reduce their tax

sample letters confirming speaking engagements, sample managerial report

Flordia travel guide, Guide loss recovery standard, Zenith 11 instruction manual, 2006 guide master tax, Company job application form.

81667

Add a comment